ADVERTISEMENT

Stride: Mileage & Tax Tracker

Finance

4.2

500K+

Editor's Review

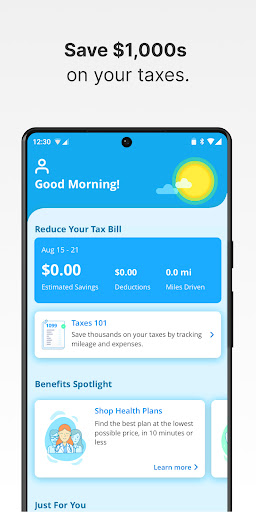

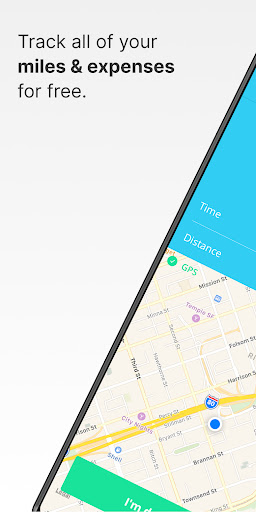

Stride is a completely free expense and mileage tracker for businesses that helps you automatically track your business miles and expenses and save thousands on your tax bill.

Built and designed for people who work for themselves, Stride’s mileage tracker helps you discover business expenses you can claim as an independent worker and makes filing a breeze. Most people save $4,000 or more at tax time by using Stride’s expense and mileage tracker!

Stride’s mileage and expense tracker helps you:

+ Save big on taxes

+ Track miles automatically

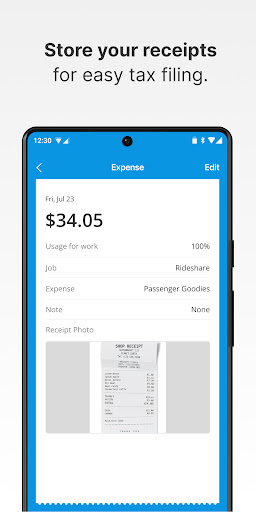

+ Log expenses like car washes and your cell phone bill

+ Take the hassle out of filing

=================================

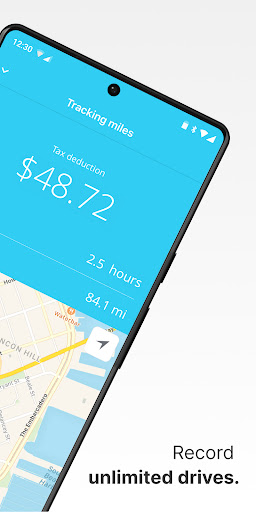

Automatically maximize mileage deductions

=================================

Just press Start when you leave the house, and Stride’s mileage tracker will automatically maximize your mileage deductions and capture them in an IRS-ready standard mileage log format. Stride’s expense tracker users get $655 back for every 1,000 miles they drive!

+ Automated GPS mileage tracking

+ Reminders to make sure you never miss out on miles

+ IRS-ready mileage logs to audit-proof your deduction

=================================

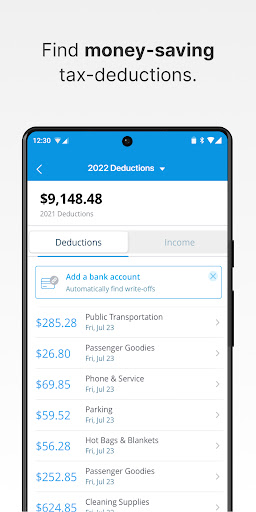

Find money-saving write-offs

=================================

We find all the expenses and deductions based on the work you do. On average, Stride finds users $200 worth of write-offs each week.

+ In-app guidance on what expenses you can deduct and how to best track

+ Bank integration to easily import expenses

=================================

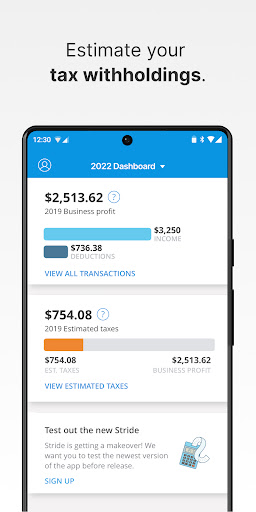

Get an IRS-ready tax report for easy filing

=================================

We prepare everything you need to file in IRS-Ready reports. Stride’s mileage and expense tracker users cut their tax bill in half on average (56%).

Gather all the information needed to file in an IRS-ready report

Support with all filing methods: e-file, tax filing software, accountant

Have all the information you need to audit-proof your taxes

--------------------------------------

Stride’s expense and mileage tracker is great for:

+ Rideshare drivers

+ Delivery drivers

+ Entertainers

+ Creative professionals

+ Food service professionals

+ Business consultants

+ Sales agents

+ Real estate agents

+ Home service professionals

+ Caregivers

+ Medical professionals

+ Cleaners

+ And many more!

ADVERTISEMENT